Job Hunting In The Layoff Era

👋 Hi, this is Ryan with another edition of my weekly newsletter. Each week, I write about topics in software engineering, big tech/startups and career growth. Send me your questions (just reply to this email or comment below) and in return, I’ll humbly share my thoughts (example past question).

Layoffs have happened at all major tech companies except for Apple at this point. Because of this, I’ve received messages from a few of you considering leaving your company. In this article, I’ll go over market data I purchased from Crunchbase Pro and LinkedIn Premium along with my thoughts on finding a new company in the layoff era.

Current Job Market

It’s no surprise that it’s harder to find a job across the board. There are fewer roles available and more competition for them. FAANG-like company hiring is limited to senior IC roles and a small amount for backfilling attrition. Despite news of doom and gloom among larger companies, there are still some smaller companies growing at a breakneck pace.

Here’s a public Google Sheet I typed out by hand containing headcount growth and fundraising rounds for some example high-growth startups.

As you can see, there are still many companies growing like rocketships (e.g. OpenAI +45%, Notion +60%, Figma +101%) within the last 6 months. In addition, some companies have raised even in the current down environment (e.g. Anthropic, Adept AI, OpenAI), which means they have a strong enough narrative and metrics to support growth still.

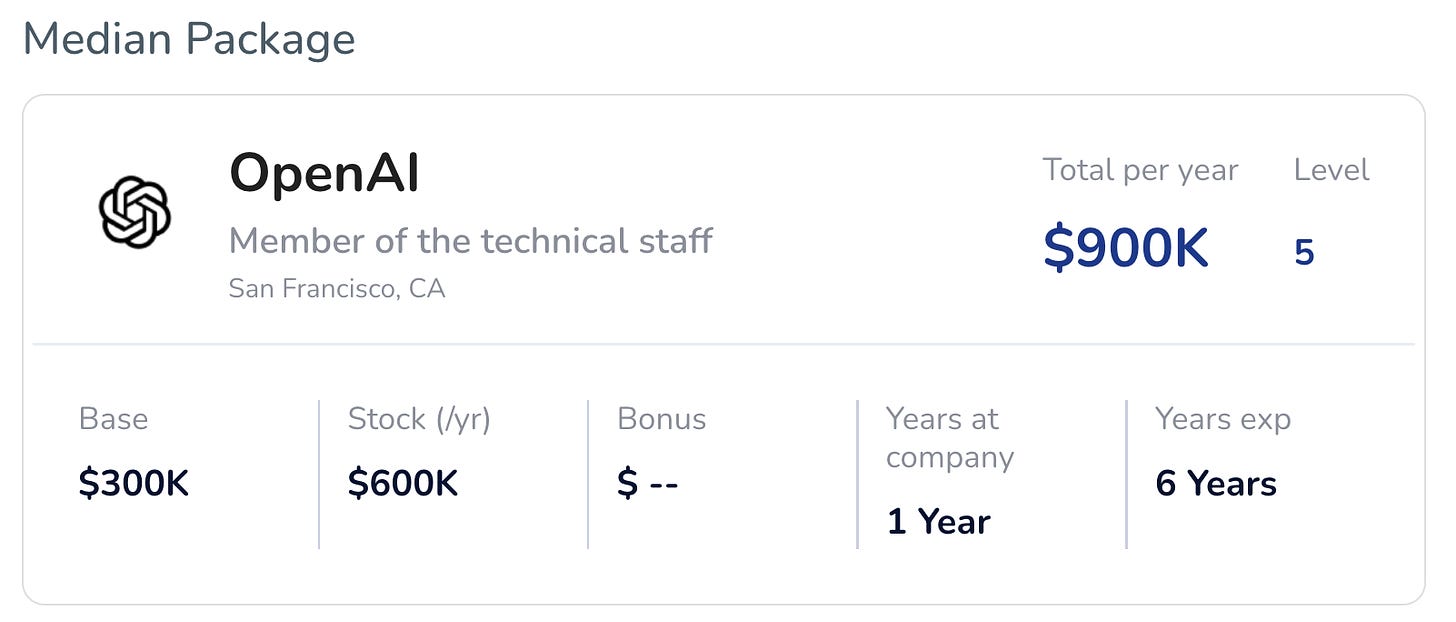

These high-growth companies have total compensation comparable to what you’d expect at FAANG as well. I pulled the median compensation for a few examples from levels.fyi to illustrate:

Picking the Right Startup

Startup and public company job searches differ significantly. Public companies have equity that is priced by the market every day. If a recruiter says your offer contains $100k of RSUs, you’ll receive that amount barring market fluctuations. Also, you don’t need to question if the company will still be around in the next few years. However, startup job searches require much more homework. There are a few key signals you should look at if you’re considering joining a high-growth startup:

Fundraising History - If a company fundraised in the past six months, it shows growth potential even in the down market. This fresh funding also increases how long the startup can survive which helps with job security. Some are even saying that these startups are more stable than FAANG-like companies in the current environment. Recent fundraising also means that the company’s valuation is more likely accurate. Avoid joining a company that raised an overvalued round in 2021 but is worth much less in reality now.

Headcount Growth - Another important signal to pay attention to is recent headcount growth. Since these are private companies, it’s difficult to get an exact measurement but LinkedIn premium insights get you pretty close. If you don’t want to pay for LinkedIn premium, you can take a look at the spreadsheet I shared earlier. Not only does this measure opportunity for career growth, but this is also one of the top signs a startup is doing well and will raise at a higher valuation later. Take it with a grain of salt though since anything can happen in startups.

Company Stage - Startup compensation and risk vary a lot depending on the stage the company is at. I wrote about compensation differences between startups and big tech here, but the summary is that smaller companies have less liquid, more volatile equity. You’ll want to make sure that the company’s stage matches your risk appetite and that the cash portion of the compensation is enough for you in the worst case.

I hope this research was helpful for folks working at FAANG-like companies interested in learning more about high-growth startups. If I missed anything or if you have any unique job-hunting insights, please share below for others to benefit. Happy to discuss with you all in the comments as usual.

Join 3800+ software engineers who receive new posts on my Substack and support my work.

Thanks for reading, Ryan Peterman